Sell Your House In Kentucky Fast For Cash

We Buy Homes As-Is!

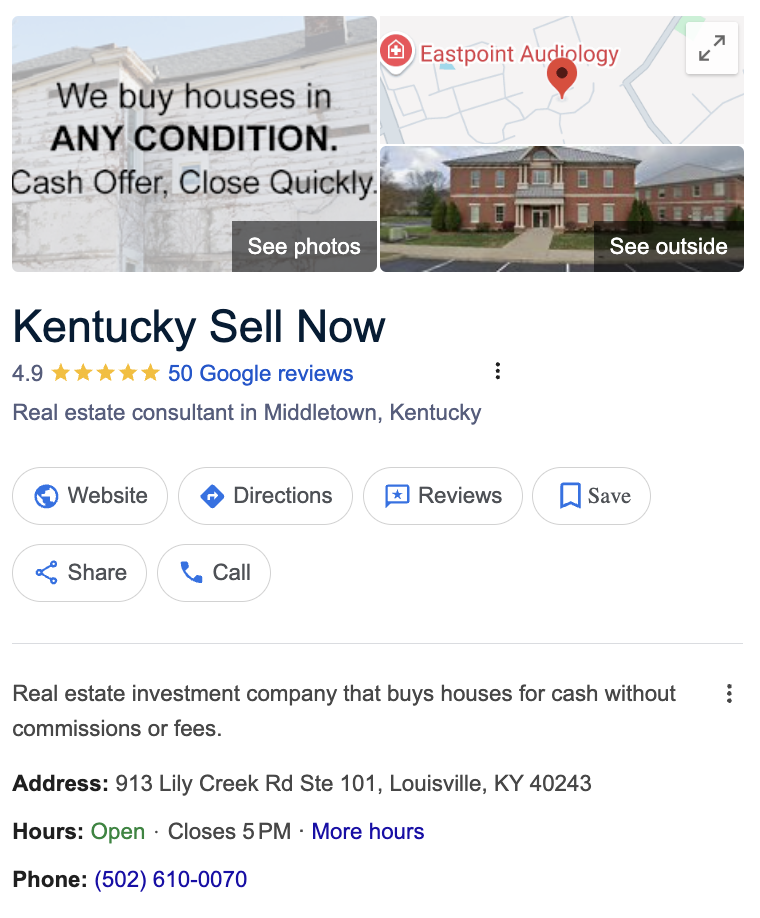

We’re Kentucky Sell Now, a local home-buying company serving homeowners in Kentucky and across KY. If you’re looking to sell your house fast, getting a fair cash offer from us is a great place to start.

We’re not here to waste your time with low offers or pushy tactics. We care about our reputation in [market-city] and work hard to make the selling process simple, honest, and stress-free.

No repairs. No cleaning. No fees. Just a straightforward cash offer and a team that’s got your back from start to finish.

Call us at (502) 610-0070 — we’d love to see if we’re the right fit for you!

“Brian with Kentucky Sell Now couldn’t have been any better to deal with. The offer was reasonable, they did what they said they would do, and did it when they said they would do it. Terms were good and they were flexible meeting our terms and needs.“

David Weinberg

Kentucky‘s #1 Cash Home Buyers

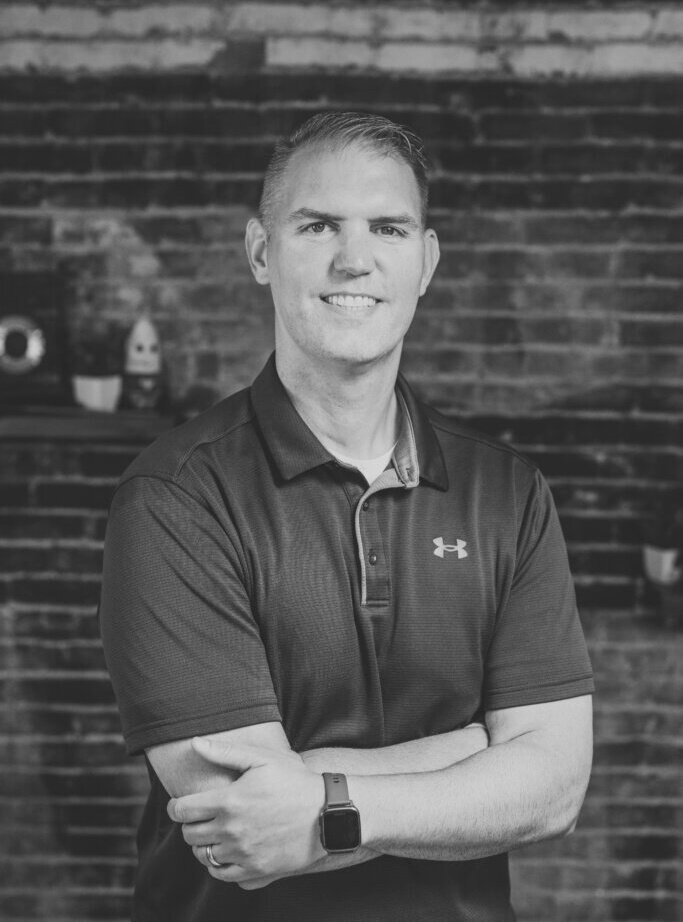

Hi, I’m Brian Hemmerle, the founder of Kentucky Sell Now. I’ve lived in Kentucky my whole life, and I care deeply about the people and communities here. I started this company because I saw too many homeowners being overwhelmed by complicated selling processes, expensive repairs, and deals that just didn’t feel fair. I knew there had to be a better way—and I wanted to be the one to offer it.

As a family man and a neighbor, I understand how important it is to feel heard and respected, especially when you’re facing a tough situation. That’s why I take the time to listen, offer real solutions, and make sure every homeowner feels supported from start to finish. To me, this isn’t just about real estate—it’s about helping people move forward with peace of mind.

That’s exactly what we do at Kentucky Sell Now. We make it simple to sell your house fast for cash, without the usual stress or delays. Whether you’re in Kentucky or anywhere else in Kentucky, we’ll give you a fair, no-obligation offer and handle the entire process from start to finish—no fees, no repairs, and no guesswork. If you’re ready for a fresh start, we’re here to help you move forward with confidence. See if our no-obligation cash offer for your Kentucky home is a good fit.

Sell your Kentucky property without an Agent 85% Quicker

We Buy Houses in Kentucky – No Matter the Condition!

Skip the fees, skip the hassle. Sell your home as-is and choose your closing date. Just fill out the form below to get started!

“Brian was so easy to work with. They were quick and efficient. After several months of working with another buyer without closing the deal, we are thankful to have found him. We were able to get a deal done and finalized in just a matter of weeks! I would recommend Kentucky Sell Now to anyone.”

Danny Gentry

IN ANY SITUATION?

Run-down, outdated—perfect! We Buy Houses In Kentucky Kentucky In ANY Situation

Sometimes life throws you a curveball, and suddenly selling your house in Kentucky wasn’t part of the plan.

Whether you’re going through a divorce, handling an inherited home, facing foreclosure, or just feeling done with it all, we’re here to help you sell your house fast for cash.

No repairs. No repainting. No deep cleaning. No expensive photoshoots.

We’re not here to judge. We’re here to give you a fair cash offer and simplify the process so you can sell your Kentucky home without the stress.

We buy houses, condos, duplexes, townhomes, commercial properties, apartment buildings, and vacant land in just about any situation. Since we don’t rely on banks or third parties to buy your home, we move fast, pay cash, and work directly with you. No waiting, no wondering—just a straightforward, all-cash offer so you can finally move on.

Avoiding Foreclosure

Falling behind on payments and feeling the pressure? We buy houses for cash and help you sell your home quickly, before it ever reaches the auction block.

Planning To Relocate

Moving for work, a fresh start, or just a change of pace? We buy Kentucky houses fast so you can focus on what’s next.

Tired Landlord

Had enough of late rent, damage, and nonstop tenant drama? Sell your house to us, no repairs or clean-up needed.

Too Many Repairs

If fixing it feels more overwhelming than keeping it, let it go. We buy Kentucky houses cash as-is, no matter the condition.

Getting a Divorce

Going through a split is hard enough. We make it easy to sell your house quickly so you can both move forward.

House in Probate

Inherited a property you weren’t expecting? We’ll buy it cash and handle it all, making it easy for you to sell your house without the usual hassle.

OUR SIMPLE SALE PROCESS

Wear and Tear? We Don’t Care—Sell Your House FAST in Kentucky!

How It Works: 3 EASY Steps

Reach Out To Us

Contact us for a FREE consult about your home. Next, get a custom cash offer based on your home’s current value.

Get Your Offer

Receive an instant cash offer on your house. Ask us any questions before sealing the deal.

Pocket Your Cash

You pick the day, we bring the money. It’s that easy. Real cash, real fast—exactly when you need it.

We buy houses and properties of all types in Kentucky and the surrounding areas. When you sell your home to us, you never have to worry about unqualified buyers, financing delays, or unexpected setbacks. As a cash for houses company, we’re different from iBuyers and corporate hedge funds. Our goal is simple: to offer you the best cash price for your house with a smooth, stress-free selling process. If you’re ready to sell your house fast in Kentucky, Kentucky Sell Now is ready to make you a fair cash offer with the quickest turnaround time.

WHO WE CAN HELP?

We Buy Homes Fast For Cash In Kentucky Kentucky

Sell Without Agents

Why deal with commissions, fees, and months of showings? Before signing an agreement with an agent, consider getting a fast cash offer for your Kentucky home. No inspection, open houses, or contingencies with us. We will buy your home for cash with no fees or price haggling.

Sell Without Repairs

Most buyers expect a home to be in perfect shape—but we’re not most buyers. You don’t have to worry about patching things up, replacing old fixtures, or hiring contractors. We buy houses in any condition, as-is. Skip the stress, and sell your house fast for cash and we’ll deal with the home repairs after the sale.

Sell Without Uncertainties

When you sell your house, it can come with a lot of unknowns. Buyer financing might fall through, negotiations can drag on, or deals collapse at the last minute. When you sell your Kentucky house to us, you get a reliable cash offer and a clear path forward. We buy houses cash, so there are no surprises and no waiting games—just a smooth home sale you can count on and the flexibility to close on your timeline.

Where We Buy Houses Kentucky

We buy homes throughout the entire Kentucky region. It doesn’t matter if you’ve tried to sell your property on your own or are thinking about hiring a realtor. We’ll buy your house for cash and bypass the listing procedure. We’ve helped numerous Kentucky homeowners sell fast. Whether you own property in Louisville, Valley Station, or Lyndon, we’ll make you an offer. As real estate investors, we can make offers on mobile homes, condos, and open land. Many homeowners dislike the traditional buyer experience. Our organization has a quick and easy approach to buy houses. We’ve taken the stress out of house selling, giving you the greatest experience when buying in the state. Contact us to sell your house fast for cash in Kentucky. We buy in any condition. Call us or use our easy contact form.

Sell My House Cash Kentucky

• Kentucky

• Ashland

• Berea

• Bowling Green

• Covington

• Elizabethtown

• Erlanger

• Florence

• Fort Thomas

• Frankfort

• Georgetown

• Princeton

Buy My House Fast Kentucky

• Salem

• Glasgow

• Harrodsburg

• Henderson

• Hopkinsville

• Independence

• Lawrenceburg

• Lexington

• London

• Louisville

• Mayfield

• Benton

Cash Home Buyers Kentucky

• Grayson

• Morehead

• Owensboro

• Paducah

• Paris

• Radcliff

• Richmond

• Shelbyville

• Somerset

• Versailles

• Winchester

• Calvert City

Useful Kentucky Blog Articles

- Can You Sell A Rental With Tenants In Kentucky

- Can I Sell My House With A HELOC In Kentucky

- Can a Cracked Foundation Be Fixed in Kentucky

- Broken Water Main to House in Kentucky

- Understanding Property Tax Rates For Kentucky Homeowners: A Comprehensive Guide

- Top Property Management Services In Kentucky: Expert Care For Your Real Estate Needs

Quick Cash For Houses Solution In Kentucky

Selling a house the traditional way in Kentucky often means dealing with repairs, closing costs, open houses, buyer financing, and real estate agents. But there’s a better way to sell your home without all the usual stress. We make it easy by offering a no-obligation quote and a competitive written cash offer. When we buy your Kentucky house for cash, we handle all the hard work, so you can skip the headaches and move forward with confidence.

We Buy Houses Anywhere In Kentucky KY

We’re Ready To Give You A Fair Cash Offer For Your House.

If you want to sell your Kentucky house or land, we’re ready to buy it and give you a fair all-cash offer. Stop the frustration of holding onto an unwanted property. Let us buy your KY house today, no matter the condition.

Avoiding foreclosure? Facing divorce? Moving? Upside down on your mortgage? Liens? We’re here to help. It doesn’t matter if the property is vacant, rented out, inherited, damaged, or behind on payments. We buy houses in any condition, even ones that need major repairs or have problem tenants.

If you have a property and need to sell it, we’d like to make you a fair cash offer and close whenever you’re ready.

Need To Sell Your House in Kentucky?

Even if an agent can’t sell your house, we can help. (In some cases, selling a house through a real estate agent isn’t the best option.)

We help property owners just like you through all kinds of situations, including divorce, foreclosure, the loss of a loved one, and burdensome rental properties. We buy houses across KY, including Kentucky, Jeffersontown, Shepherdsville, St. Matthews, and other nearby areas — paying a fair cash price fast.

Sometimes homeowners are just too busy to handle everything it takes to get a house ready to sell. If that sounds like you, simply tell us about the property you want to get rid of, and we’ll help you sell your house fast for cash.

Ya’ll really treated me right. Made it simple and easy. I really appreciate it.”

– James

Advantages of Working With The Kentucky Sell Now Team in Kentucky

![Cash House Buyers Near Me Kentucky]](https://image-cdn.carrot.com/uploads/sites/31685/2022/10/Cash-House-Buyers-768x1024.jpeg)

Meet Brian Hemmerly —The guy that sells your house fast!

Brian’s the guy you want in your corner—solid, straight-up, and always looking out for his fellow Kentucky neighbors. Brian isn’t just about making deals; he’s about making sure you feel good about ‘em. Honest and reliable, he loves cutting out the middle man because agents just burn holes in our wallets!

We don’t like wasting your time or ours. We won’t lowball you. We’ll present a fair cash offer so you can know immediately whether we’re a good buyer for you. If you want to learn more about how we buy your home fast, call us today.

Sell your Kentucky house without a Real Estate Agent 85% Quicker

We buy houses in Kentucky in ANY CONDITION. No hidden fees or commissions. Sell it fast and on whichever day you want.

Selling a House for Cash Kentucky FAQs

Curious about how Kentucky Sell Now’s fast cash home buying works?

Browse our most frequently asked questions to learn more.

Why is a cash offer better for a seller?

When you work with a local home cash buyer, the process is simple, straightforward, and transparent from start to finish, with no surprises along the way. Our cash offer team has earned real reviews and testimonials from Kentucky homeowners we’ve helped sell quickly and stress-free. As a trusted cash home buyer, we’re committed to giving you a competitive offer within hours, so you can sell your house fast and skip the delays and headaches of a traditional sale.

Can you sell a house in Kentucky in 5 days?

Some closing processes can take days, weeks, and months to finalize. That is not the case with us. If you have a clear title, we can buy your Kentucky house and close the deal in as little as five days.

What is the quickest way to sell a home in Kentucky?

Selling your house for cash is a smart way to avoid the hassles of traditional listings and buyers relying on conventional financing. We make it easy with a simple, no-hidden-fee process to sell your home quickly in Kentucky, KY. Our goal is to help you sell in the shortest time possible. Unlike typical cash home-buying companies that make you wait for payment, we move fast. To close, all titles must be clear of liens, with no outstanding taxes or unpaid mortgage balances.

Is selling my house for cash in Kentucky a good idea?

If you need to sell your Kentucky home fast, selling for cash is a smart choice. Our buyers understand the value of a smooth, straightforward process without the delays and complications of a traditional sale. Still deciding if selling for cash is right for you? Get a free, no-obligation offer from us. It only takes a few minutes to review your options, and we’ll give you the information you need to make the best decision for your family and financial future.

Will cash for houses companies buy my house that is already listed?

Yes, we can still help. Spending hours working with realtors can feel overwhelming, but you’re not stuck. We buy houses in Kentucky, KY, and the surrounding areas, whether your property is listed or not.

Easiest Way to Sell Your Home As-Is in Kentucky

At Kentucky Sell Now, we buy houses for cash in Kentucky and the surrounding areas. As trusted real estate professionals and local cash home buyers, we make it easy to sell your house fast — no repairs, updates, or cleaning needed. We’ll buy your home as-is and handle everything for you.

If you’re ready to sell your Kentucky house and want a fair, competitive cash offer, we’re here to help. Selling in today’s market can be overwhelming, but with us, there are no commissions, no hidden fees, and no stress. We believe every homeowner deserves to be treated with honesty, respect, and fairness.

When you need a simple, fast way to sell your Kentucky house for cash, trust the team at Kentucky Sell Now. We buy houses every day and would love to make you an offer you can feel good about.

Sell Your House Quickly in Kentucky 💰

We buy houses in Kentucky As-Is! No Hidden Fees or Real Estate Commissions. Sell Your House in Kentucky And Close On The Date Of Your Choice. Simply Fill Out The Form, or call (502) 610-0070 today!

Sell My House For Cash Kentucky KY Sell My House For Cash Kentucky KY We Buy Houses Kentucky KY Cash Home Buyers Kentucky KY

*

| Kentucky home | properties | fair cash offer | cash offers | Kentucky home | 2024 |

| fast offer | house sell | properties | realtors | sell my house fast Kentucky KY | sell house |

| we buy homes Kentucky | cash for homes Kentucky | we buy ugly houses Kentucky | home selling | cash for properties | buyer |

| cash buyer | fast cash buyer | buyer | COMPETITIVE MARKET | properties | property |

| faster cash Kentucky | cash buyers | house buying | ibuyers | investors | MLS |

| real estate investors | we buy houses Kentucky KY | HOMEOWNER INSURANCE | HOMEOWNER’S INSURANCE | FLAT FEE MLS | FLAT-FEE MLS |

| sell my house fast Kentucky | cash house buyer | TRANSFER FEES | cash offer | fair sale | EXCISE TAX |

| NEGOTIATION | INTEREST RATE | EARNEST MONEY | PRICE | FOR SALE BY OWNER | CALCULATOR |

| TITLE COMPANIES | REAL PROPERTY | HOME APPRAISAL | FSBO | FLAT FEE | SELLER’S MARKET |

| we buy houses as-is | fast home buyers | Kentucky home buyers | property address | sell your house cash Kentucky | money |

![we buy houses for cash [market_city]](https://image-cdn.carrot.com/uploads/sites/31685/2022/11/We-Buy-Houses-Cash-Home-Buyers.png)

![Reviews of Customer we buy houses [markey_city]](https://image-cdn.carrot.com/uploads/sites/31685/2022/10/Reviews-of-Customer-we-buy-houses.png)

![Client Review we buy houses Kentucky]](https://image-cdn.carrot.com/uploads/sites/31685/2022/10/Client-Review-we-buy-houses.png)